Pivotal One and Cloud Foundry—Great Promise, Great Challenge

Great opportunity

Earlier today in a Twitter chat led by John Furrier of SiliconAngle, we discussed whether Pivotal One is vapor—or real. This post expands my opinion on the subject.

Pivotal‘s promise is that using their tool set, an IT architect can fill the entire “meat section” between raw virtual machines and an application. All in one shot. Indeed, at Altoros, we see more and more customer deployments involving every piece of the pie involving NoSQL/NewSQL and Hadoop data stores, real-time and analytics engines, messaging and apps deployed and scaled with the help of a PaaS layer.

To the naked eye, Pivotal’s offering makes a lot of sense, as it brings a one-stop solution that addresses quite a lot of the needs of next-generation application architecture at an average enterprise IT shop.

Great challenge(s)

On March 13, 2013, when the Pivotal Initiative was announced, a high bar was set for the company. That is, to achieve $1B in revenue in 5 years. I believe that a few things should come together for this to happen.

If Pivotal can solve two key challenges–making a quantum leap in market leadership for a few more of their products and integrating the entire product suite into a single platform—they will probably not only achieve $1B in revenue in 5 years, but will have an amazing shot at becoming the bellwether of enterprise software moving ahead.

Challenge #1: “Best-of-breed incumbents”

Competing products are quickly becoming “best-of-breed” incumbents in five categories of next generation enterprise software where Pivotal is playing:

- Hadoop

- Massively Parallel RDBMS, with focus on analytics

- Next-generation databases

- Analytics

- PaaS

I estimate between 5–15% of mid- to large-sized companies in the US are in the process of rapidly adopting tool sets from all of the five product categories present within the Pivotal product portfolio.

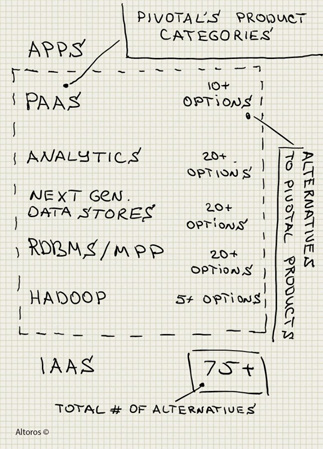

I counted a total of 75+ competing products in the Pivotal product portfolio. On one hand, you can feel option paralysis when it comes to selecting “best-of-breed” pieces of the stack. That plays in favor of Pivotal, but only when business decision-makers can get their teams to adopt a single platform.

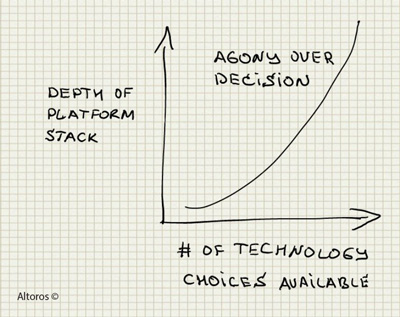

In the majority of IT/developer-lead opportunities, the challenge for Pivotal is to consistently outrun “best-of-breed” stand-alone category leaders that are being hand-picked by developers and small IT groups. To win the “best-of-breed” competition, Pivotal needs to achieve a market leadership position in perhaps half of the five market segments which are components of the Pivotal platform. That is hard.

Challenge #2: Platform sell

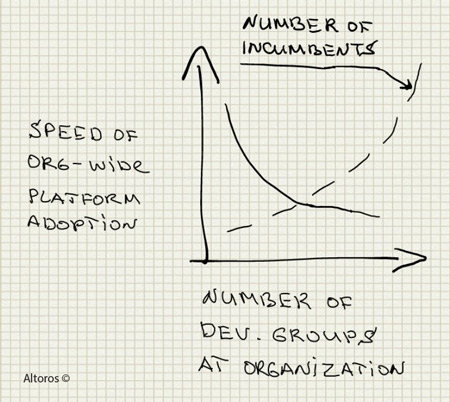

Building a rich, broad, integrated product that will actually drive lots of change across all stakeholders at many levels (developers, devops, IT, management and general management) makes it even harder. Across our customers at Altoros, we see many more architectural/tooling decisions being made deep within organizations, as devops teams sit at the next desk to the software teams making autonomous decisions.

Lets face it, an increasing number of software engineering groups nowadays get more freedom to use the “best-of-breed” technology of their choice, instead of using the recommended “one-and-only” tool dictated from above. While it’s relatively easy to sell a piece of the platform as “best-of-breed,” it’s much harder to satisfy everyone with a single “platform,” especially in large organizations with many autonomous groups of developers and DevOps engineers.

Adoption is key

I believe that over the course of 2010-2012, the bottleneck to a broader adoption of PaaS was not the lack of a business case, but the lack of a broad, well-coordinated, enterprise-wide IaaS adoption.

One of Altoros’s customers is in an industry that requires signing a business associates’ agreement with any vendor having anything to do with their sensitive data. And believe it or not, that customer said he would prefer to use AWS alongside with their private cloud, even though he wasn’t sure how AWS can sign a business associate agreement while not allowing a full “soup to nuts” security audit of its infrastructure.

For better or worse, AWS did an amazing job of making doing business in “real-time, on-demand” a “new normal” within enterprise IT on all levels. Amazon Web Services educated a lot of enterprise IT folks while upping their security and SLAs to be “enterprise-compliant.” And it’s a good thing for the PaaS vendors, including Pivotal. AWS is making the public cloud a first class citizen within enterprise IT. Looking ahead, as early as 2015 we probably will see PaaS adoption on a massive scale, as companies large and small look beyond IaaS.

Partners

Someone shared a concern that Pivotal’s partner announcements are “barney deals” partnerships. I can testify that these partner teams on the other side of the pond are working very hard to make these partnerships work. Most likely they work that hard because they have a lot to gain. Although the community around core open source project Cloud Foundry is not yet mature, it is growing very quickly.

During twitter chat on the subject of this post, CIO advisor and pundit Tim Crawford pointed out that “success and failure of #cloud solutions will ultimately rest w/ the value of their ecosystem.” While Pivotal certainly does well when it comes to the width of their ecosystem, attending to Cloud Foundry, time will tell how committed Pivotal organization to making these partners successful, especially in areas of conflict of interest. In one of my next posts, I will elaborate on one of such conflicts.

Summary

Looking at the first six months since the Pivotal Initiative was officially born, it has made solid progress. I believe Pivotal will make a big bet on the Cloud Foundry PaaS as a dispensary of anything that moves on top of IaaS layer, including many competing components from existing and potential incumbents. Should the stars align well, Pivotal has good chances of hitting a home run.